How to Create a Basic Stock Portfolio Tracker in Excel

Managing a stock portfolio is essential for any investor, and creating a stock portfolio tracker in Excel is one of the simplest and most effective ways to do so. Whether you’re a beginner investor or an experienced trader, Excel offers powerful tools to organize, analyze, and monitor your investments. In this article, we’ll walk you through a step-by-step process to create a basic stock portfolio tracker in Excel.

Why Use Excel for Stock Portfolio Tracking?

Excel provides flexibility, customization, and ease of use for tracking your stock investments. Here are some key benefits:

- Customizable Layout: Design the tracker to suit your preferences.

- Powerful Formulas: Automate calculations for returns, gains, and losses.

- Data Visualization: Create charts and graphs to visualize performance.

- Cost-Effective: No expensive software subscriptions required.

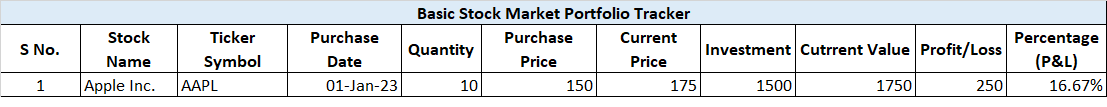

Step 1: Set Up Your Excel Sheet

Start by opening a new Excel workbook. Use the following steps to create the basic structure:

- Name Your Sheet: Rename the sheet as “Stock Portfolio Tracker” for easy identification.

- Create Column Headers: In the first row, enter the following headers:

- Stock Name

- Ticker Symbol

- Purchase Date

- Quantity

- Purchase Price

- Current Price

- Investment Amount

- Current Value

- Profit/Loss

- Percentage Change

Step 2: Enter Your Stock Data

Input your stock information under the respective headers. For example:

- Stock Name: “Apple Inc.”

- Ticker Symbol: “AAPL”

- Purchase Date: “01-Jan-2023”

- Quantity: 10

- Purchase Price: 150

- Current Price: 175 (you’ll update this regularly).

Step 3: Add Formulas for Automated Calculations

Now it’s time to leverage Excel formulas to make your tracker dynamic. Here’s how:

- Calculate Investment Amount: In the “Investment Amount” column, use the formula:

=D2 * E2This multiplies the Quantity (Column D) by the Purchase Price (Column E). - Calculate Current Value: In the “Current Value” column, use the formula:

=D2 * F2This multiplies the Quantity (Column D) by the Current Price (Column F). - Calculate Profit/Loss: In the “Profit/Loss” column, use the formula:

=H2 - G2This subtracts the Investment Amount (Column G) from the Current Value (Column H). - Calculate Percentage Change: In the “Percentage Change” column, use the formula:

=(H2 - G2) / G2 * 100This shows the profit or loss as a percentage of the initial investment.

Step 4: Format Your Tracker

- Use Conditional Formatting: Highlight rows or cells based on specific criteria. For example:

- Green for positive profits.

- Red for losses. To do this, go to Home > Conditional Formatting and set rules.

- Apply Number Formatting: Format the “Current Price,” “Investment Amount,” “Current Value,” and “Profit/Loss” columns as currency. Use Home > Number Format to select “Currency.”

- Freeze Panes for Easy Scrolling: Keep your headers visible while scrolling by going to View > Freeze Panes > Freeze Top Row.

Step 5: Update Regularly

Your tracker is now ready! Update the “Current Price” column periodically to see real-time changes in your portfolio’s performance. You can manually check prices or use live data integration (explained below).

Bonus: Automate with Real-Time Stock Data

To take your tracker to the next level, consider pulling live stock prices into Excel:

- Use the Stock Data Type in Excel 365:

- Highlight your “Ticker Symbol” column.

- Go to Data > Stocks to convert them into a stock data type.

- Use the “Insert Data” button to add real-time price information.

- Use an API like Alpha Vantage or Yahoo Finance to fetch live data (requires some technical setup).

Step 6: Visualize Your Portfolio Performance

Add charts to monitor performance over time. For example:

- Create a Pie Chart to visualize the allocation of your portfolio.

- Use a Line Chart to track changes in total portfolio value.

- Highlight relevant data, go to Insert > Charts, and select your preferred chart type.

Conclusion

A stock portfolio tracker in Excel is an invaluable tool for managing your investments. It allows you to keep track of your portfolio’s performance, monitor profits and losses, and make informed decisions. By following the steps in this guide, you’ll have a fully functional tracker that you can customize and improve over time.

For advanced stock market analysis, tips, and predictions, visit our blog at Stocklord.in. Stay consistent with updates, explore Excel’s advanced features, and take control of your financial journey. Happy investing!

0 Comments on “How to Create a Basic Stock Portfolio Tracker in Excel”