Calculator Templates in Excel

Microsoft Excel offers calculator templates which are pre-designed spreadsheets performing specific calculations such as mortgage payments, loan payments, and budget calculations. Pre-configured formulas and cell structures come with these templates, making complex calculations easier without creating the formulas from scratch. Loan calculators, savings calculators, budget calculators, and investment calculators are some common calculator templates in Excel. You can use a calculator template in Excel by simply opening the template, entering the relevant data, and the template will perform the calculation for you. This saves time and effort compared to creating the calculation from scratch. This page provides access to many pre-designed calculator templates.

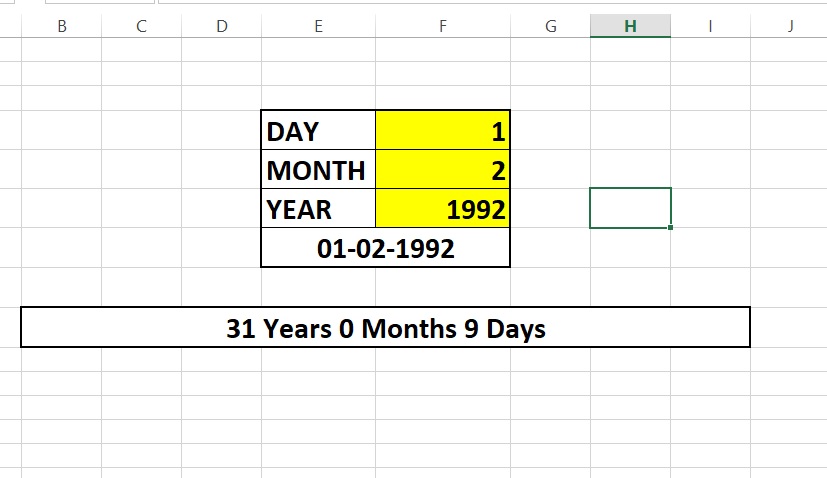

Age calculator in Excel

A person’s age can be determined by using an age calculator, which calculates the number of years, months, and days elapsed since their date of birth by subtracting it from the current date.

Age calculators are available in various forms, including paper-based, software-based, and online calculators. In Microsoft Excel, you can create a simple age calculator using the “=DATEDIF” function, which calculates the difference between two dates and returns the result in years, months, or days. A more complex calculator can also be created that considers factors like leap years.

Age calculators find applications in various fields, such as personal finance, healthcare, human resources, and genealogy. They can also be used for personal purposes, like tracking milestones or determining the age of family members or friends.

Download the template by clicking on the below button. Read more about the Age calculator here.

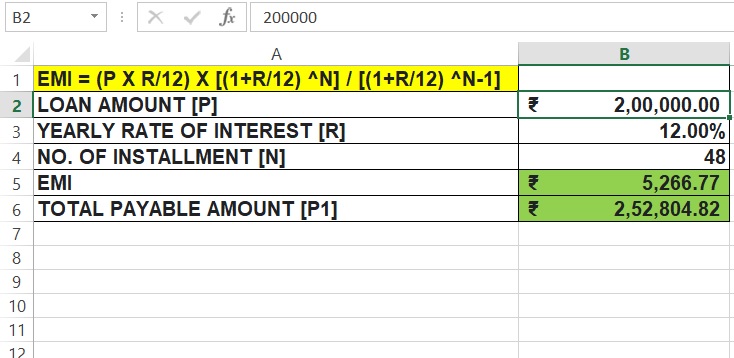

Loan EMI calculator in Excel

A Loan EMI (Equated Monthly Installment) calculator is a tool that calculates the monthly payment you will have to make to repay a loan. An EMI is the fixed amount you pay each month to repay the loan, including both the principal amount and interest. The amount of the EMI depends on the loan amount, interest rate, and loan term (duration of the loan).

The EMI calculator uses the following formula to calculate the EMI:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

where: P = Loan Principal R = Monthly Interest Rate (interest rate divided by 12) N = Number of monthly payments

You can find loan EMI calculators online or in spreadsheet software such as Microsoft Excel. By using an EMI calculator, you can calculate the monthly payment required to repay the loan and make informed decisions about borrowing and lending.

Moreover, an EMI calculator can also compare different loan options by inputting different loan amounts, interest rates, and loan terms. This helps in finding the best loan option that suits your budget and requirements.

Download the template by clicking on the below button. Read more about the Loan EMI calculator.

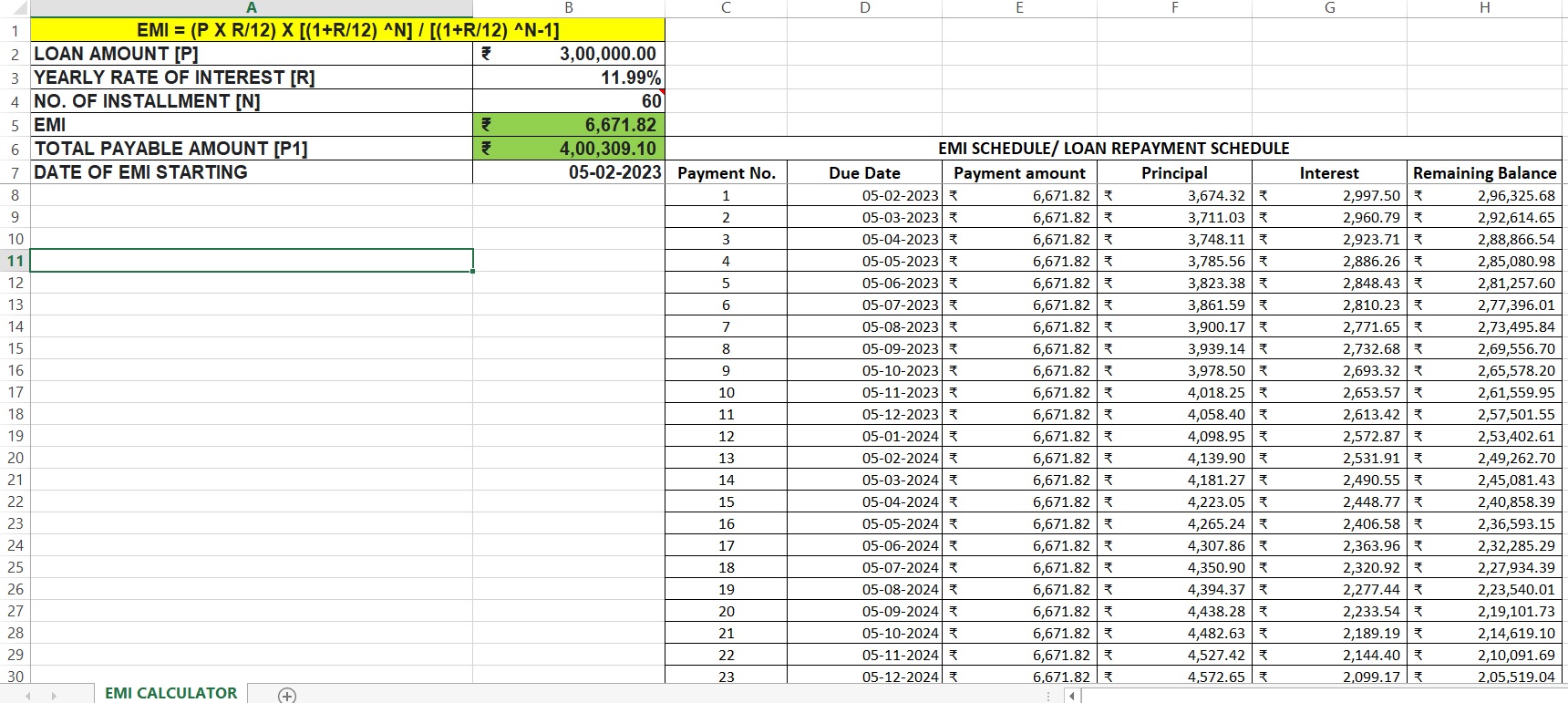

Loan Repayment Schedule

A loan repayment schedule is a table that outlines the payment schedule for a loan, including the amount of each payment, the due date, and the remaining balance after each payment is made. It provides a clear and detailed plan for repaying the loan over a specified period of time.

Loan repayment schedules accurately reflect the payment schedule for the entire loan term by taking into account the fact that each payment reduces the principal balance of the loan, resulting in decreasing interest over time. They help borrowers understand their loan obligations, plan their budget, and avoid late fees and damage to their credit score. Loan repayment schedules can also be useful for lenders to track the performance of their loan portfolio and monitor borrower performance.

Download the template by clicking on the below button. Read more about Loan Repayment Schedule.

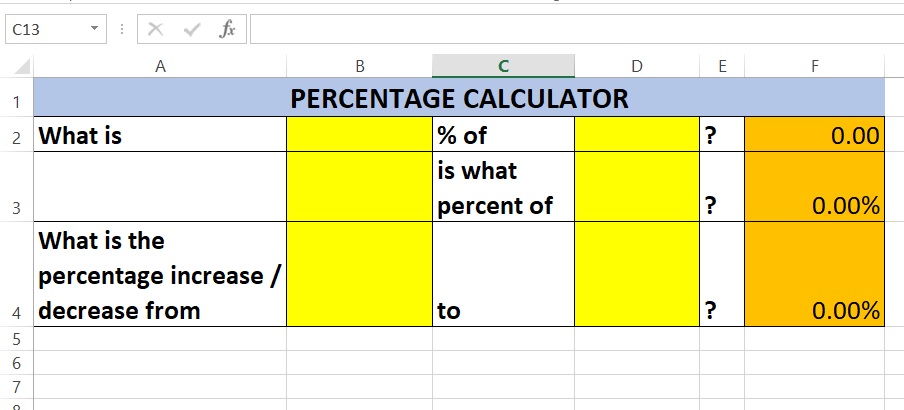

Percentage Calculator

A percentage calculator is a tool used to perform calculations related to percentages. It can be used to find the percentage of a number, calculate the increase or decrease of a number as a percentage, and perform other types of percentage-based calculations.

Online and spreadsheet software like Microsoft Excel provide percentage calculators to perform various calculations. These include finding the percentage of a number, determining the number corresponding to a percentage of another number, and calculating the percentage increase or decrease between two numbers.

For example, percentage calculators can help in determining the sales tax of an item. By entering the cost of the product and the sales tax rate, the calculator can accurately calculate the sales tax you owe.

Percentage calculators are used in various fields like personal finance, education, and business to quickly and accurately perform calculations involving percentages. They are useful in making informed decisions by working with percentages.

Download the template by clicking on the below button. Read more about the percentage calculator.

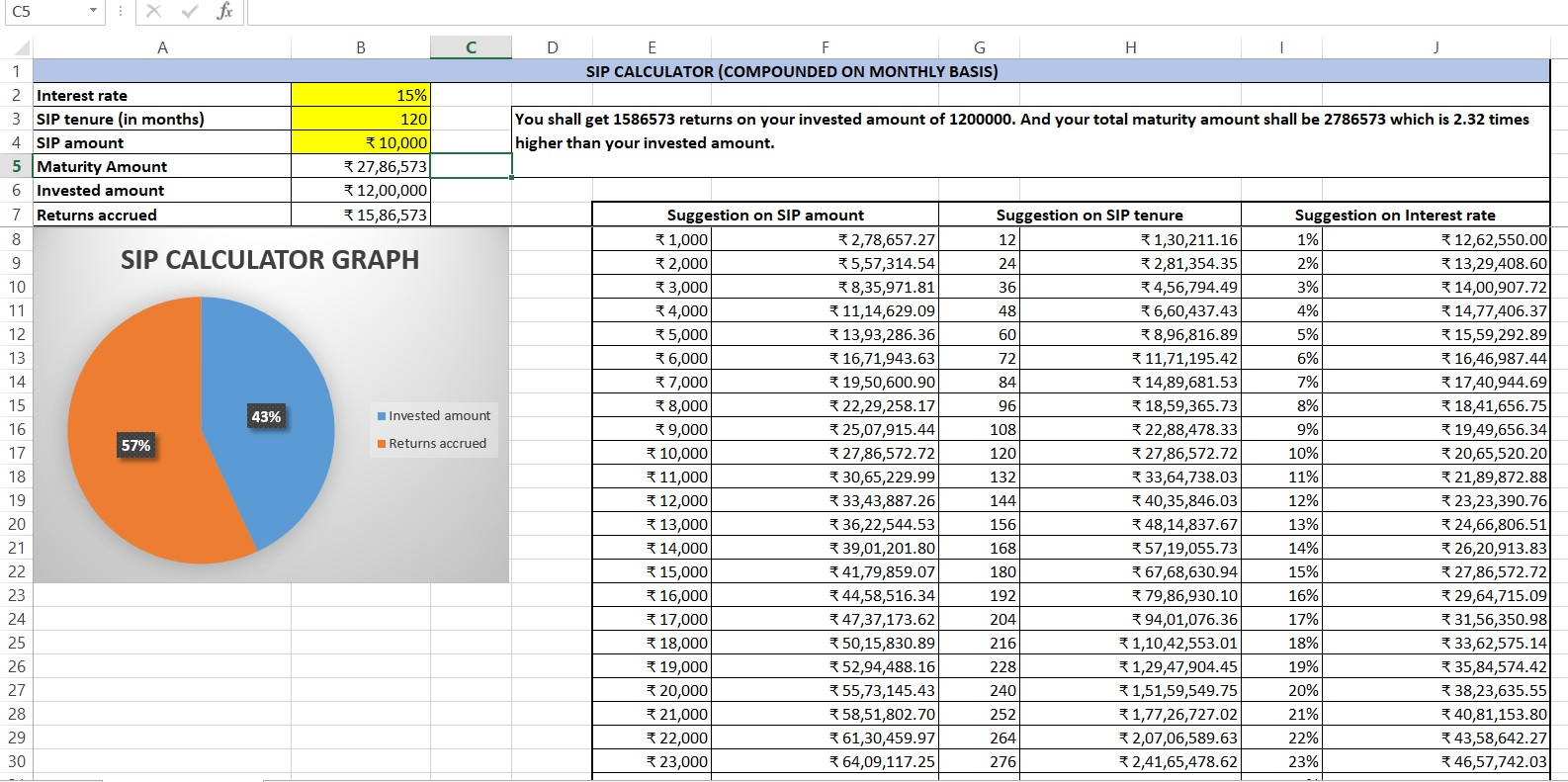

SIP calculator

A Systematic Investment Plan (SIP) calculator is a tool used to calculate the potential returns from a regular investment made into a mutual fund. SIP is a type of investment strategy in which a fixed amount is invested at regular intervals (e.g., monthly or quarterly) in a mutual fund instead of making a lump sum investment.

The SIP calculator works by using the following information:

- The amount of the regular investment

- The frequency of the investment (e.g., monthly or quarterly)

- The expected rate of return

- The investment horizon (the number of years the investment is expected to continue)

The SIP calculator can estimate the potential returns from the investment, including the final corpus and the returns generated over the investment horizon based on the provided information. SIP calculators are easily accessible online and user-friendly. It helps to determine the potential returns from a regular investment, enabling informed decisions about investment strategies.

SIP calculators are particularly beneficial for long-term mutual fund investors who seek to understand the potential returns from their investments. These calculators can also compare potential returns from different investment options to identify the most suitable one for their investment goals and risk tolerance.

Download the template by clicking on the below button. Read more about the SIP calculator.

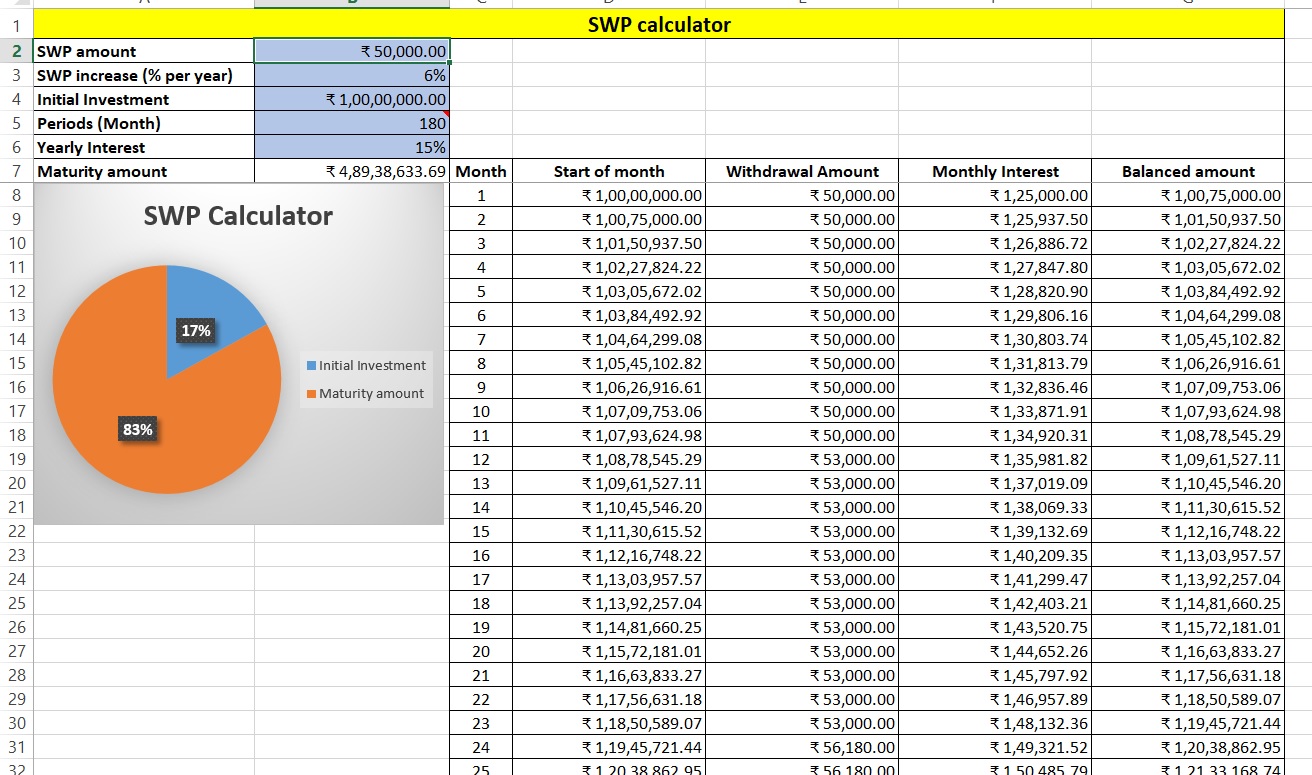

SWP calculator

SWP stands for Systematic Withdrawal Plan, which is a type of investment strategy used by individuals to generate a regular income from their investments in mutual funds. In an SWP, the investor makes regular withdrawals from their investment, typically on a monthly or quarterly basis, over a specified period of time.

An SWP calculator is a tool used to estimate the amount of regularly generated income from an SWP. The calculator typically requires the following information to perform the calculation:

- The amount of the initial investment

- The expected rate of return on the investment

- The frequency of withdrawals (e.g., monthly or quarterly)

- The amount of each withdrawal

- The investment horizon (the number of years the investment is expected to continue)

Based on the given information, the SWP calculator can estimate the potential returns from the investment, including the amount of regularly generated income and the remaining balance of the investment at the end of the investment horizon. SWP calculators are easily accessible online and user-friendly. It helps to determine the amount of regular income that an SWP can generate, allowing for informed decisions about investment strategies.

SWP calculators are especially beneficial for individuals seeking to generate regular income from their mutual fund investments. They can compare potential returns from different investment options, enabling them to find one that best suits their investment goals and risk tolerance.

Download the template by clicking on the below button. Read more about the SWP calculator.